At Applied Quantum, we help financial institutions navigate the point where quantum technology, cryptography and regulation meet. We work with banks, insurers, market infrastructures and fintechs to protect critical flows today while exploring where quantum and quantum‑inspired methods can create real advantage in risk, pricing and optimisation.

Sector Overview

Financial services sit at the sharpest intersection of cryptography, regulation and high‑value data. Banks, insurers, market infrastructures and payments providers are already living with long regulatory memories and long data lifetimes – and are some of the earliest adopters of advanced optimisation and analytics.

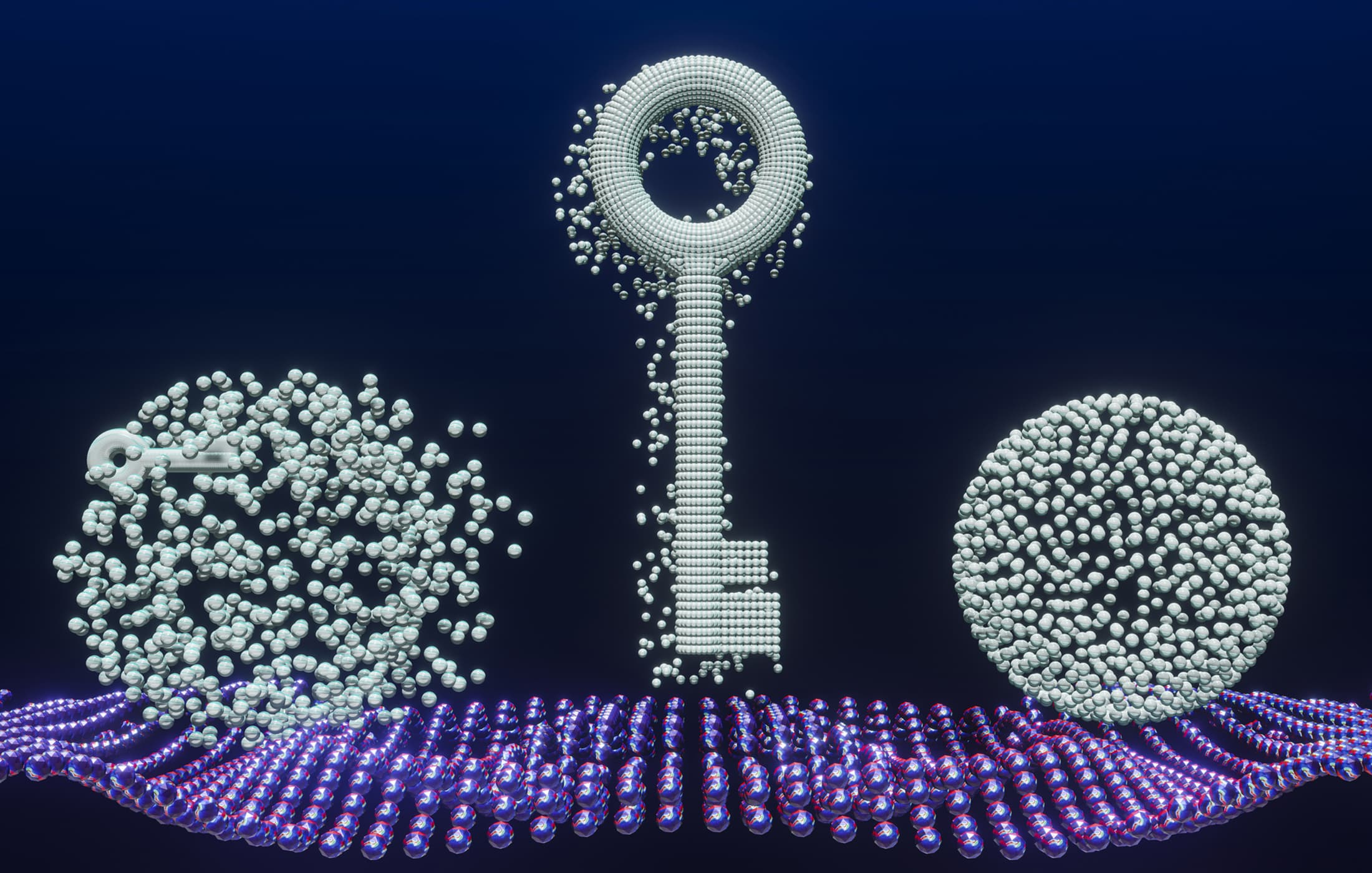

Quantum shows up on both sides of the equation:

- as a threat to public‑key cryptography and long‑lived transactional, customer and trading data;

- as a potential advantage in pricing, risk, optimisation, and simulation – if it is applied to the right problems at the right time.

Our work in this sector is about connecting those two realities: using quantum and quantum‑inspired tools where they help, while building credible PQC and crypto‑modernisation programmes that keep regulators, boards and market infrastructures comfortable.

Who we work with

We support a broad range of organisations across the financial ecosystem, including:

- Retail and commercial banks – core banking, channels, payments, lending and identity.

- Investment banks and capital‑markets firms – trading, prime brokerage, derivatives and structured products.

- Asset managers and hedge funds – portfolio optimisation, risk, research and analytics.

- Insurers and reinsurers – pricing, risk modelling, Cat risk, exposure management, claims data.

- Financial market infrastructures – exchanges, CCPs, CSDs and RTGS / settlement systems.

- Payments, card schemes and remittance providers – card networks, instant payments, wallets and merchant acquiring.

- Fintech, neobanks and embedded‑finance platforms – digital‑first players under pressure to demonstrate security and innovation at the same time.

Where quantum matters

Building with quantum and quantum‑inspired methods

- Exploring quantum and quantum‑inspired optimisation for portfolios, collateral, routing, liquidity and capital allocation.

- Investigating quantum approaches to Monte Carlo, derivative pricing and risk models – with a cold eye on timelines and baselines.

- Running PoCs on scheduling, routing and resource‑allocation problems in treasury, operations and logistics.

Defending against the quantum computing threat

- Assessing “harvest now, decrypt later” exposure in payments, custody, trading, customer data and archives.

- Planning PQC and crypto‑modernisation across thousands of applications, HSMs, APIs and vendor products.

- Coordinating with FMIs, schemes, SWIFT and regulators so change happens in step with the ecosystem.

Key challenges we see in financial services

- Large, heterogeneous estates with multiple generations of cryptography and vendors.

- Regulatory expectations that are tightening.

- Difficulty translating quantum risk into business and regulatory language.

- Competition for talent and budgets with other transformation programmes (cloud, AI, etc.).

- Many attractive‑sounding “quantum use cases” that lack realistic timelines or a business cases.

How Applied Quantum helps

- Quantum Security, PQC & Risk – quantum‑readiness assessments, cryptographic inventories and CBOMs, PQC and crypto‑agility roadmaps, key‑management and HSM/KMS design, quantum‑risk assessments for payments, trading and custody.

- Strategy & Opportunity – sector‑specific quantum strategy, capability assessments, market & investment insights for quantum plays and vendors, use‑case discovery and prioritisation.

- Engineering & Implementation – design and execution of optimisation and simulation PoCs, cloud‑based quantum integration, secure architectures for quantum‑enabled analytics.

- Commercialization & TTO Support – for internal ventures and spin‑outs in quantum finance, risk and infrastructure; market intelligence and partnership strategies with vendors and FMIs.

Relevant Case Studies

Quantum‑Risk and Cryptography Assessment for Interbank Payments

Independent Validation of a Quantum‑Enabled Security Product

PQC Roadmap for a Global Bank

Relevant Insights

The Challenge of IT and OT Asset Discovery

Sign Today, Forge Tomorrow (STFT) or Trust Now, Forge Later (TNFL) Risk

Introducing Quantum AI (QAI)

If you’re starting to ask what quantum really means for your balance sheet, payment flows or trading and risk platforms, we’d be happy to talk.

Whether you need a PQC roadmap, a quantum‑risk view for your regulators, or a sanity check on proposed use cases, we can help you shape a plan that fits your organisation and ecosystem.

- Inquire about our services

- Request detailed analyst reports

- Learn about our educational programs

- Discuss partnership opportunities

- Explore our R&D collaboration

- Get support for your quantum security

- Request a demo of our solutions